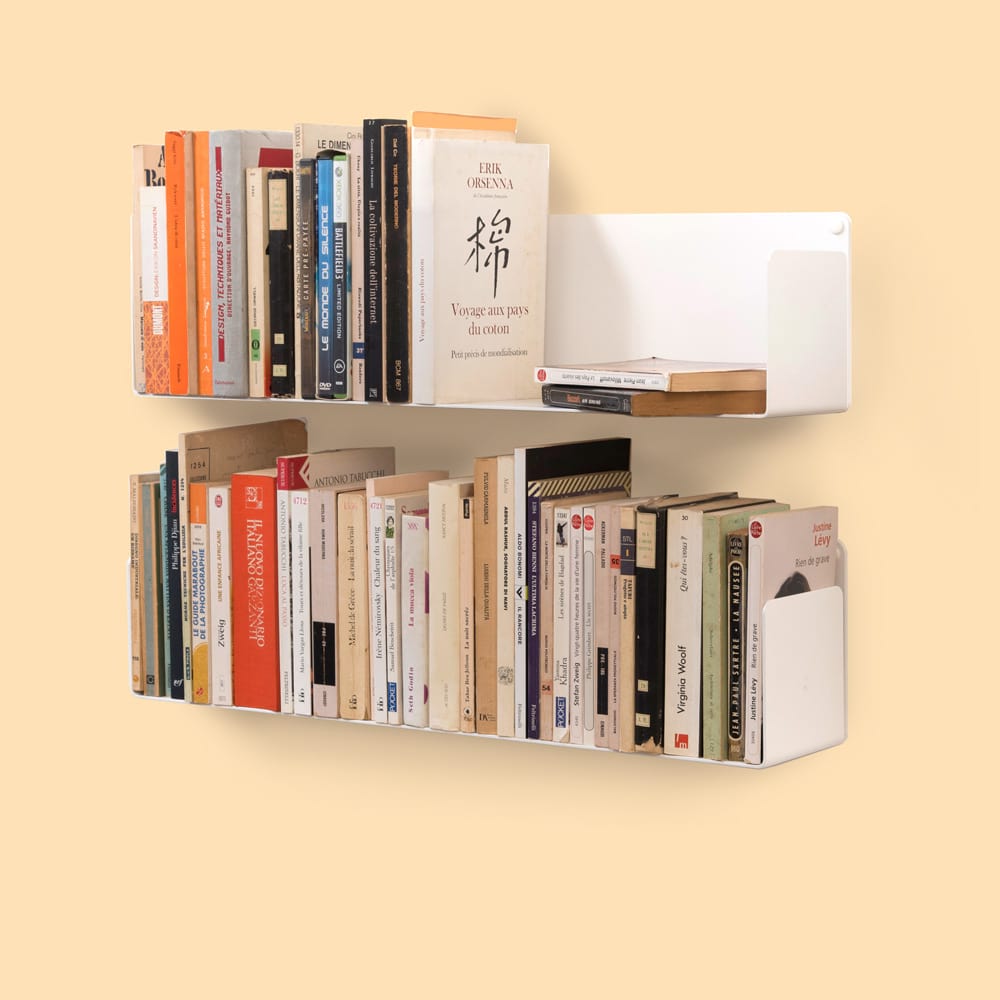

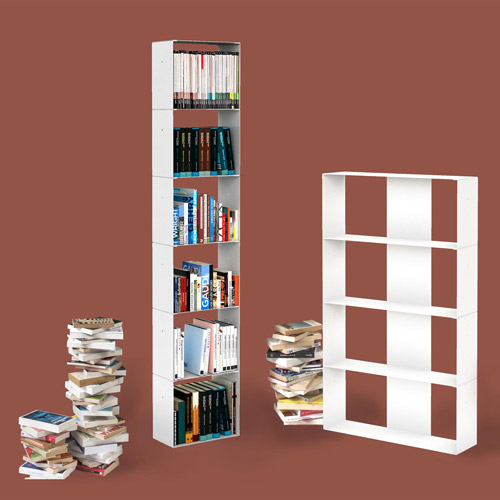

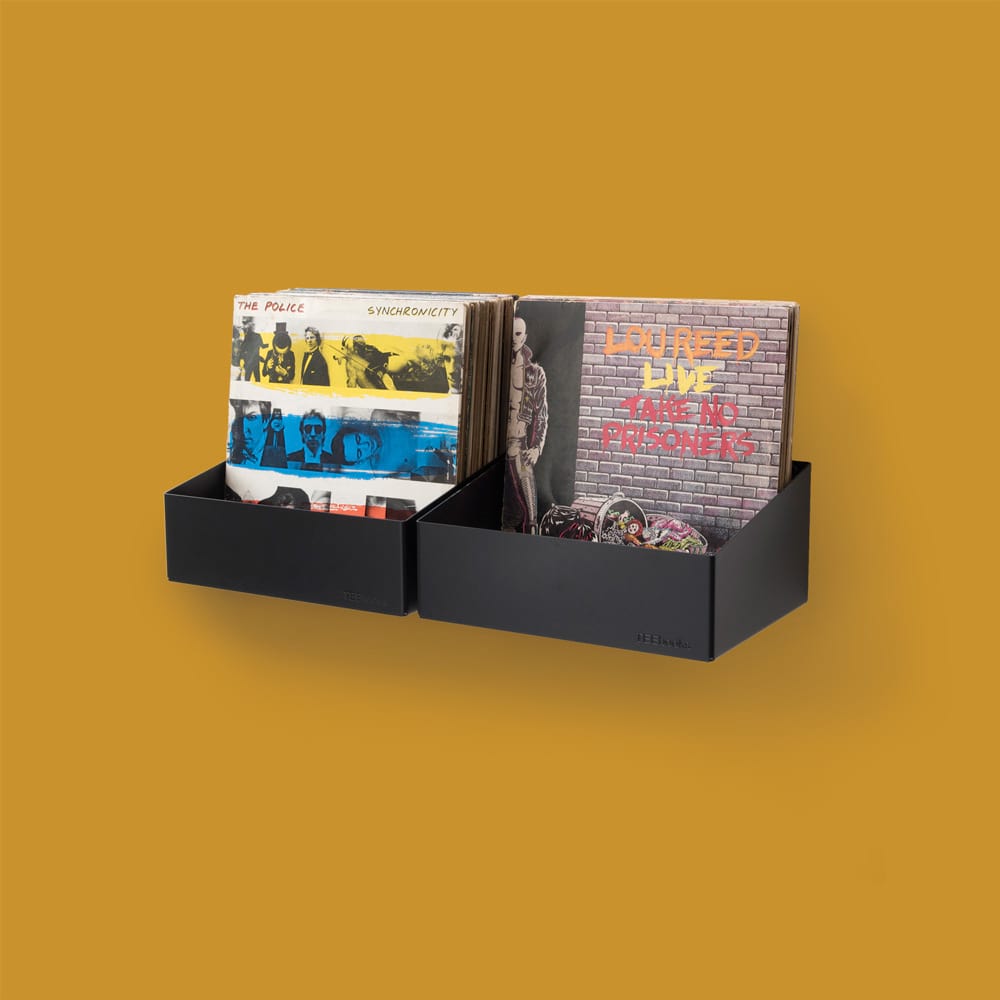

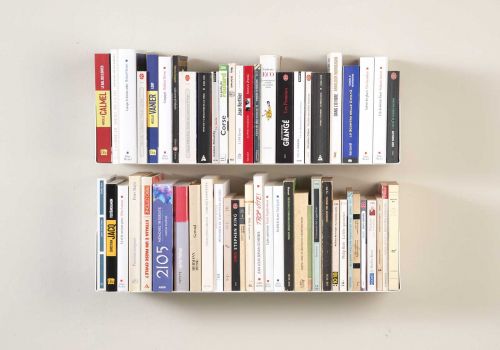

Étagère design by TEEbooks

Notre sélection d'étagères

Voir tous

-

Prix 46,80 € Prix normal 78,00 € -31,20 €

Prix 46,80 € Prix normal 78,00 € -31,20 €- Nouveauté !

- -40 %

-

Prix 138,00 € Prix normal 150,00 € -12,00 €

Prix 138,00 € Prix normal 150,00 € -12,00 €- -8 %

-

Prix 98,00 € Prix normal 118,00 € -20,00 €

Prix 98,00 € Prix normal 118,00 € -20,00 €- Nouveauté !

- -16 %

-

Prix 135,00 € Prix normal 150,00 € -15,00 €

Prix 135,00 € Prix normal 150,00 € -15,00 €- -10 %

-

Prix 229,00 € Prix normal 260,00 € -31,00 €

Prix 229,00 € Prix normal 260,00 € -31,00 €- Prix en baisse

- -11 %

-

- Prix en baisse

- -9 %

-

- Prix en baisse

- -13 %

Simple, Utile et Design

Nos étagères s'adaptent à tous vos styles d'intérieur

Découvrez nos étagères

Trouvez votre inspiration